It all started when…

Exit Planning is a relatively new discipline that requires a specific understanding of some of the issues, and a general understanding of many of the issues, that surround this field of study. We hold the professional credential of Certified Exit Planning Advisor (CEPA) as a testament to our commitment to remain on the cutting edge of this new discipline.

We find assisting owners with the successful exit or transition from their business to be a very personally satisfying service. We define a successful exit as one that aligns the business, financial and personal goals of the owner that can be summarized by the accomplishment of 3 main goals and objectives:

1. Maximize the value of the business on exit

2. Minimize Estate and Capital Gains Taxes

3. Maximize the owner’s post exit satisfaction, ready and willing to meet life’s next challenge, financially secure and personally content.

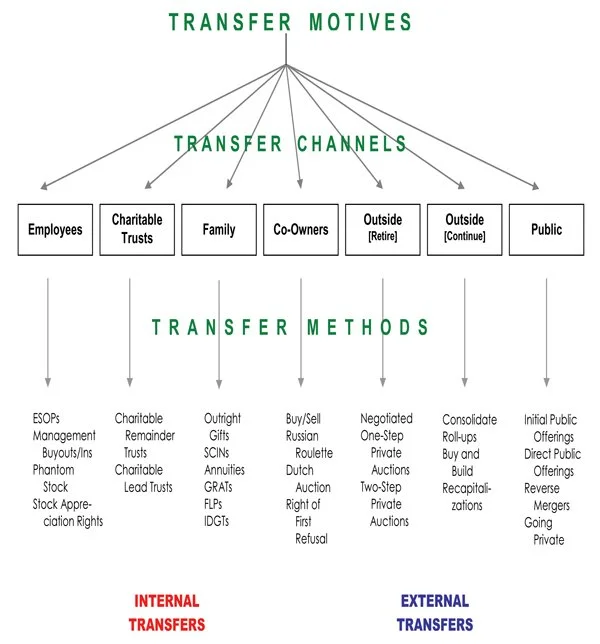

There are over 30 different options available for an owner to Exit or Transition out of their business. A CEPA will ensure that all options are considered and help guide the owner to the solution that most closely meets their goals and objectives. The chart below summarizes the potential exit or transition options an owner may pursue:

fter reviewing the chart, I am sure you will agree that engaging the assistance of a CEPA will add value to the option choice decision. The Exit Plan itself is a complex process that includes many factors to consider.

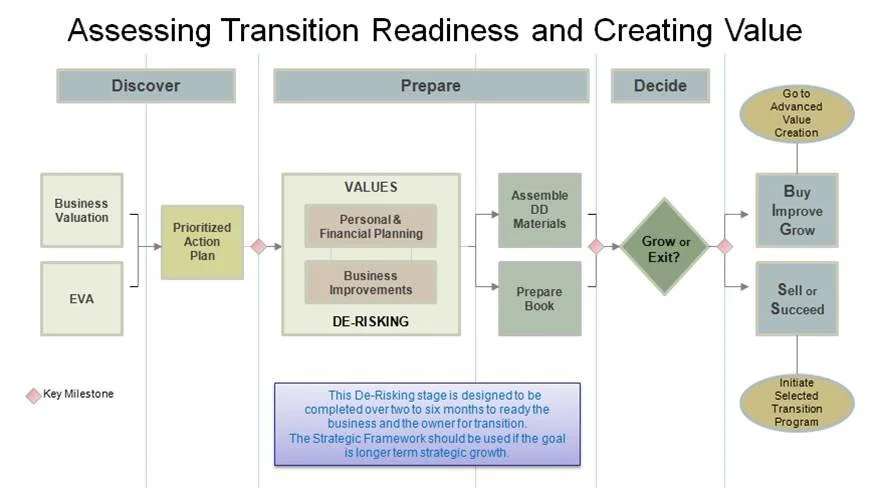

Deciding whether you can immediately prepare for a transition or need to create additional value to meet your post exit financial goals is key. The chart below outlines our process and the tasks that need to be completed in order to make that important decision:

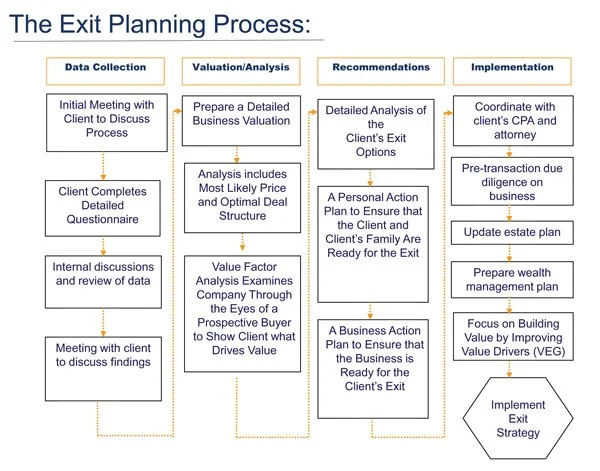

The Exit Planning Process can be summarized in the chart below:

Additional information on Olin Capital Advisors Exit Planning Advisory Services can be found by clicking on this link which will take you to our Custom Exit Web site.

Succession Planning

Succession Planning’s focus is on a family or related party transfer of a business interest. Specifically, the leadership of the company changes, usually to another family member. Leaving the family business to the next generation is a popular and powerful tool to ensure your legacy lives on and your children can maintain, or preferably, enhance the value of the business. Management buyouts are also considered a part of succession planning.

Business owners considering succession planning can also benefit from the counsel of a Certified Exit Planning Provider.

• Provide an independent, 3rd party to ensure family/management relations remain intact.

• Provide information on access to capital for next generation buyout

• Suggest Exit Options to take advantage of various discounts for control and marketability to minimize tax implications.