Ever try to find a needle in a haystack? Finding an acquisition that meets all your corporate goals and objectives can be daunting.

Buy Side Advisory services are provided to those clients that have made the decision to promote growth through a Merger or Acquisition Strategy. The trick is to find the best fit available. Many potential target businesses do not know they want to sell, until approached, or are very secretive about being for sale.

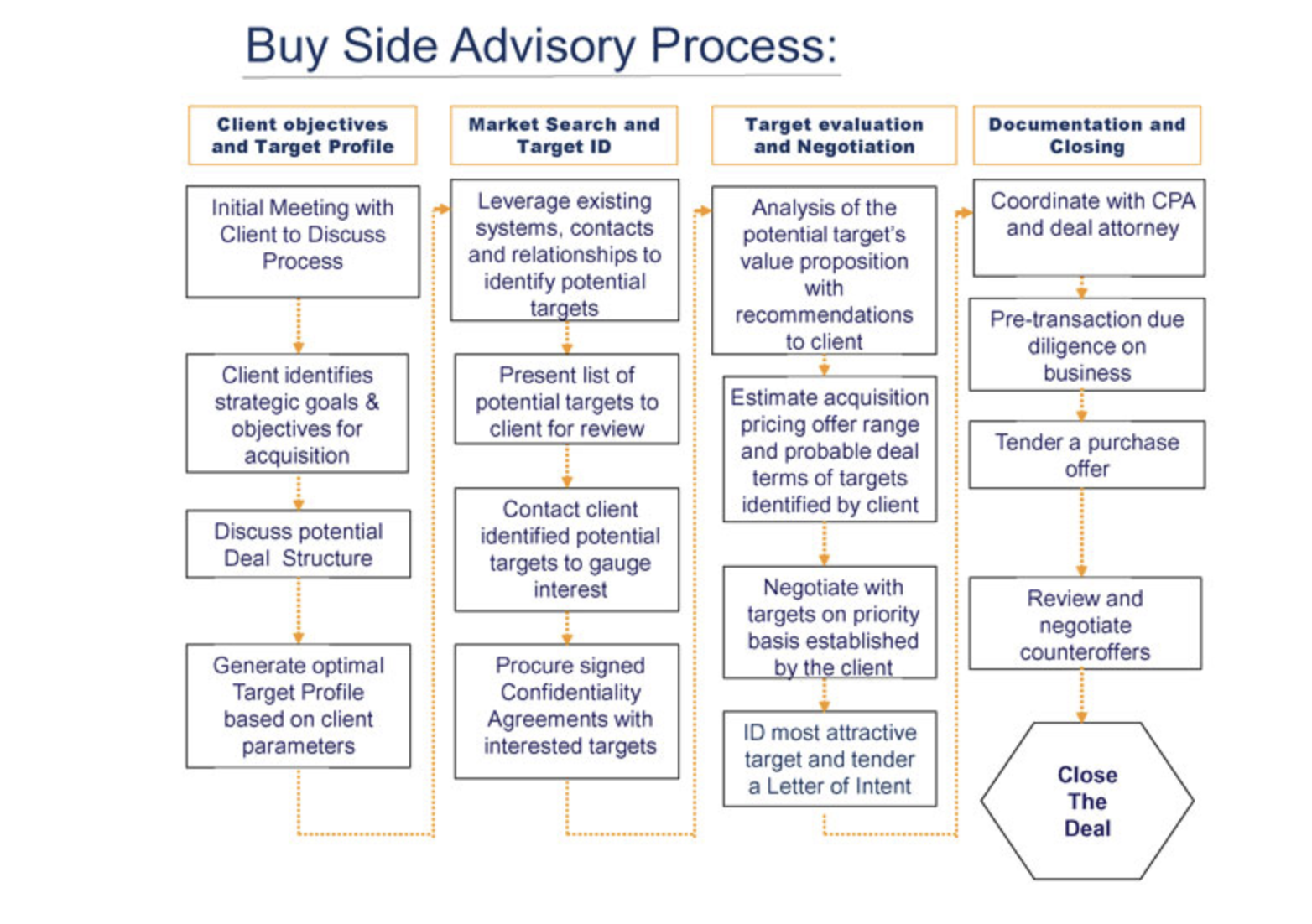

Olin Capital Advisors will leverage our experience, contacts, and in place systems, to assist our buyer clients with the identification of potential targets, evaluate the target’s value proposition based on the client’s goals and objectives and negotiate the purchase of the selected acquisition. The chart and narrative below generally outline the processes:

Phase I: Client objectives and Target Profile

During this phase, Olin Capital Advisors analyze the owner's objectives, growth strategy, and Industry. A “target profile” is generated which identifies the characteristics of a prototype target. Possible deal structures and terms are discussed.

PHASE II: Market search & target identification

At this point, Olin Capital Advisors takes the profile of the probable target and identifies companies that match that profile. We then draw upon our experience in the marketplace, extensive contacts and relationships of its principals, and in place systems to reach out to potential targets. Olin Capital Advisors professionals make the initial contact with potential targets, gauging interest and conveying the client’s intent to buy the right company.

Confidentiality Agreements are signed. Information is exchanged and Olin Capital Advisors perform a review of target submitted financial documents to estimate possible sales price range.

Phase III: Target evaluation and Negotiation

Olin Capital Advisors, along with close participation with the owner, negotiates the terms and conditions of the offer to all potential targets. Counteroffers are evaluated based on various uses of cash, owner notes, earnouts and bank financing considered against the client’s stated goals and objectives

Phase IV: Documentation and Closing

During this Phase Olin Capital Advisors coordinates the efforts of transaction team members to ensure that the transaction is closed efficiently. The owner's focus can remain on the profitability of his company rather than on the transaction process. Loss of profitability during the transaction process can be detrimental to the overall success of the sale.