Owners who decide to sell their business to a 3rd party should consider Olin Capital Advisors to perform the functions this complicated process entails. Industry nomenclature is confusing but, the services we offer are referred to by different names:

1. Mergers & Acquisitions Intermediaries

2. Investment Bankers

3. Business Brokers

4. Exit Planners

Selling your business for maximum value is a complicated process that is best accomplished using a firm who specializes in those services. The Value we add to the Sell Side Advisory service includes:

Time- the amount of time necessary to accurately price, effectively market, negotiate and close a deal is substantial. An owner time is better spent keeping their enterprise running profitably through the sales process, rather than allowing poor financial performance resulting from their additional time demands to cause value erosion.

Bandwidth - We will increase the number of potential buyers for your business by using established marketing channels, contacts and in place systems to ensure the sale is considered by the greatest number of potential buyers thereby, maximizing value.

Expertise – a credentialed and experienced Investment Banker can lend their expert analysis, established marketing channels, contacts and in place systems to the process and broaden the audience, ensuring the highest value to the owner.

Objectivity – hiring a professional M&A intermediary guarantees an unbiased and measured evaluation of your business value, strengths and weaknesses. Owners, understandably, cannot remove themselves emotionally from the process which could force unintended consequences.

Advocacy – We will gain a thorough understanding of your personal, financial and business goals, adopting them as if our own, resulting in a transfer that meets, or exceeds, those goals and your expectations.

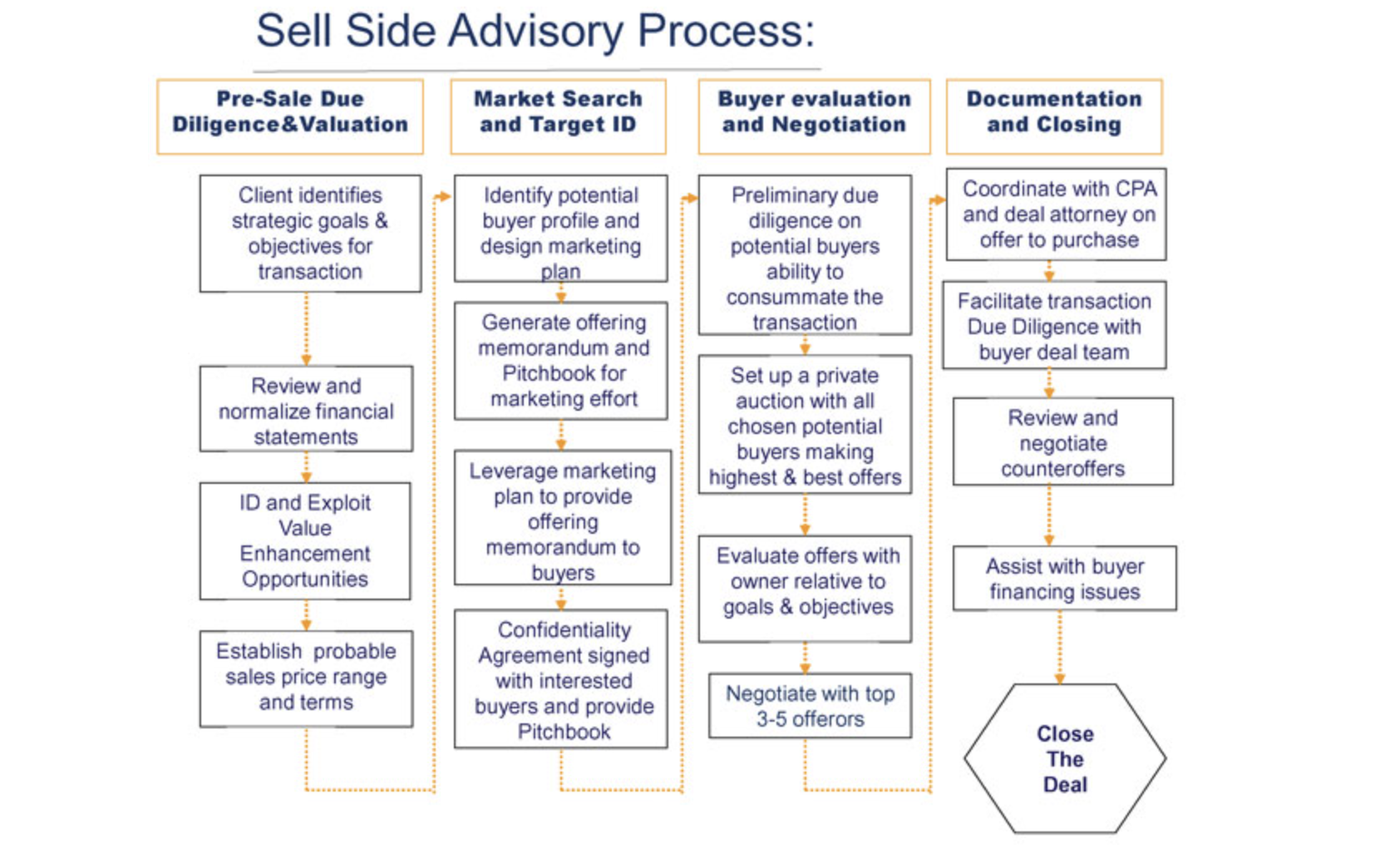

Phase I: Pre-Sale Due Diligence and Valuation

During this phase, Olin Capital Advisors analyze the owner's objectives, growth strategy and Industry. A “target profile” is generated which identifies the characteristics of a prototype target. Possible deal structure and terms are discussed.

Phase II: Marketing Search and Target Identification

At this point, Olin Capital Advisors develop a profile of the probable buyer and identifies companies that match that profile. To attract these buyers, Olin Capital Advisors creates a "Confidential Offering Memorandum" that provides potential buyers with a cursory glance of our client by describing the company for sale and gives potential buyers enough information to confirm an interest in the client company. We then draw upon our experience in the marketplace, extensive contacts and relationships of its principals, and in place systems to reach out to potential buyers. Olin Capital Advisors professionals make the initial contact with potential buyers, handling additional requests for information and conveying the client's intent to sell.

Potential buyers are required to sign Confidentiality Agreements before receiving the more complete disclosure of information necessary to make an offer or, learning the identity of your company. A "pitchbook" is produced that provides all of the information potential buyers need to make an informed, credible offer for the company.

Concurrently, Olin Capital Advisors perform preliminary due diligence on potential buyers to assess their ability to consummate the transaction. Subsequently, all qualified buyers begin the private auction process which will result in the most beneficial offer for your business.

Phase III: Buyer evaluation and Negotiation

Olin Capital Advisors, along with close participation by the owner, negotiates the terms and conditions of the offers from all potential buyers. Offers are evaluated based on various uses of cash, owner notes, earnouts and bank financing compared to the owner's stated goals and objectives

Phase IV: Documentation and Closing

During this Phase Olin Capital Advisors coordinate the efforts of transaction team members to ensure that the transaction is closed efficiently and that the former owner receives all compensation memorialized in the purchase agreement. The owner's focus can remain on the profitability of his company rather than on the transaction process. Loss of profitability during the transaction process can be detrimental to the overall success of the sale.